📢 Introducing Our First Edition of This Week in Climate Tech 🌍

We’re excited to launch our weekly climate tech newsletter, where we will bring you fresh insights each weekend into the latest shifts and innovations. This week, Trump’s re-election initially sent ripples through renewable energy stocks, but the sector’s resilience is clear. While the MAC Global Solar Energy index and NextEra saw dips, the Inflation Reduction Act’s $369 billion in funding remains largely intact, backed by bipartisan support. With renewable energy costs falling and market dynamics driving growth, climate tech’s momentum is stronger than ever.

From high-stakes investments to new advancements in electric aviation and agritech, join us every week with Firstime Ventures as we track the future of climate tech.

💡 In the Spotlight

While renewable energy stocks initially tumbled on Trump’s re-election this week – MAC Global Solar Energy index dropping 10% and NextEra falling 6.2% – the sector’s underlying strength is undeterred. The Inflation Reduction Act’s $369 Billion remains largely intact with bipartisan support, as 90% of investments flow to red districts. Market dynamics, not elections, continue to drive momentum: solar and wind costs have plunged 88% and 68%, making them more affordable than ever. Evidence builds daily—TotalEnergies maintaining U.S. investment plans, Saint-Gobain securing major renewable deals, Archer landing $500M aviation contracts, and Northern-Arc launching a $65M climate fund in India. Global investors with $33T in assets demand climate action, and states like California are approving $10B in climate bonds. The green transition is accelerating on solid commercial footing, moving beyond political dependency.

⚡️ Energy Transition

Archer secures potential $500M Japanese deal through JAL-Sumitomo venture for 100 electric aircraft, targeting 2025 commercial launch.

Norwegian FREYR enters US solar manufacturing by acquiring Trina’s $340M Texas facility amid growing domestic production push.

Beta Technologies raised $318M Series C funding from Fidelity, TPG, and Qatar’s QIA, advancing electric aircraft production and certification.

Mainspring Energy secures $96M to manufacture fuel-flexible Linear Generators, establishing a large-scale Pittsburgh manufacturing facility.

French ZE Energy secures €54M led by Amundi Energy Transition for European solar-storage expansion strategy.

Polish solar attracts €81M investment as Econergy and Phoenix secure a long-term deal with a global industrial buyer.

Norwegian Glint Solar receives $8M Series A backing to scale global solar development software across European markets.

Meta expands Texas solar footprint through 260MW Engie partnership, strengthening US data center renewable supplies.

Retail giant H&M partners with Lightsource bp on a 125MW Texas solar farm, expanding US corporate renewable procurement.

French industrial Saint-Gobain locks 110GWh renewable supply through 20-year Boralex partnership across three facilities.

♻️ Circular Economy & Novel Materials

DOE backs Moment Energy’s $20M Texas battery recycling facility, targeting EV-to-grid storage conversion market.

🚜 Ag-Tech

Days after US elections, DFC backs Indian agritech platform Arya.ag with $19.8 million, strengthening Indo-Pacific digital agriculture investments.

Marine robotics startup Ulysses raises $2M from Lowercarbon Capital, commercializing automated seagrass restoration with government partnerships.

☁️ Carbon-Tech

Canada backs Pratt & Whitney’s $34.9M advanced thermal engine research, aiming to reduce aviation emissions through improved fuel efficiency.

🌳 Other Climate News

UAE signals regional energy transition leadership with $54B commitment while maintaining position as key global energy supplier.

Global investors managing $33 trillion unite ahead of COP29, demanding stronger climate policies to accelerate private sector climate investments.

California strengthens West Coast climate leadership with $10B bond approval, advancing offshore wind and grid infrastructure development.

Days after the US elections, DFC channels $50M into Indian climate fund, maintaining American green financing commitments in Asia.

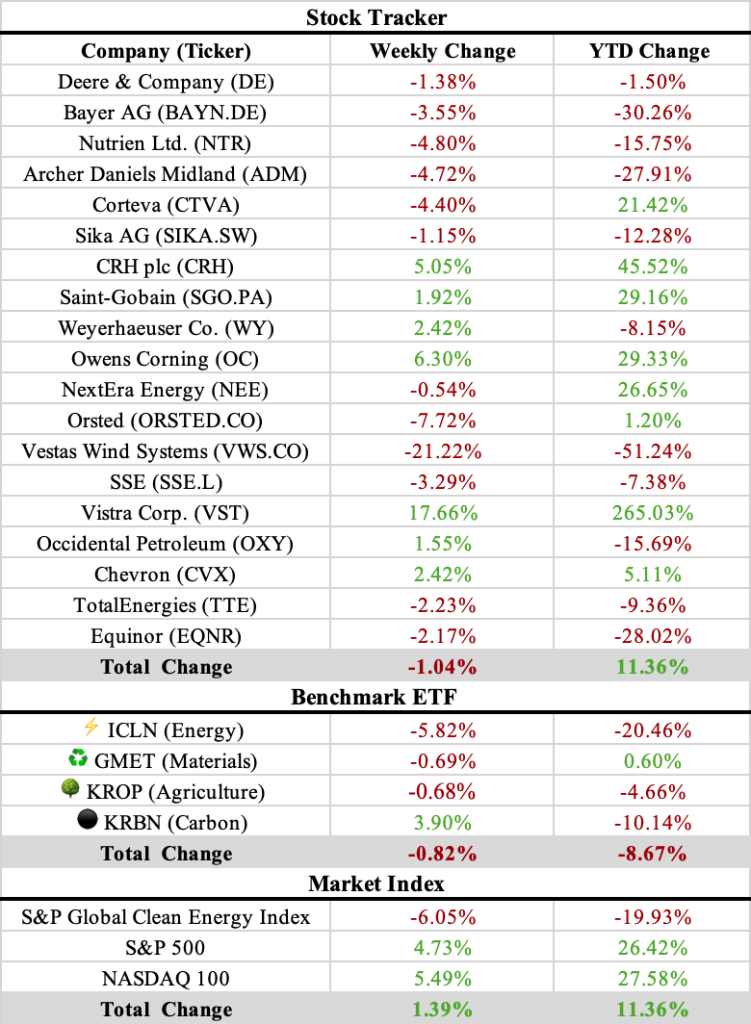

📈 Market Monitor

Our Market Monitor tracks the performance of key stocks and sector ETFs, providing weekly and year-to-date changes for market analysis and trend identification.

📝 Omer Agadi, Data Analyst, Firstime Ventures